Inhaltsverzeichnis

- 1 This is an old version of this page. To the new page please click here

- 2 Das ist eine alte Version dieser Seite. Zur neuen Seite klicken sie hier

- 3 Overview

- 4 Using the „VAT check book"

- 4.1 Calling the VAT check book

- 4.2 Selection of suppliers or customers and actions

- 4.2.1 Default settings for the test service and your own VAT:

- 4.2.2 Action: Show list of master data

- 4.2.3 Action: Update list without check

- 4.2.4 Action: Check „Flagged OK" Addresses

- 4.2.5 Action: Check VATs via Web Service

- 4.2.6 Action: Individual check of business partners

- 4.2.7 Single VAT number check

- 4.2.8 VAT Check Service

- 4.3 Functions on the result (ALV) List

- 4.4 F1 Context for VAT Check Status and Check

- 4.5 Individual checking of VAT numbers

- 4.6 VAT Check App

This is an old version of this page. To the new page please click here

Das ist eine alte Version dieser Seite. Zur neuen Seite klicken sie hier

Overview

This document describes the usage of the software „EPO VAT Check for SAP" for the users of this solution. EPO VAT Check enables you to

- audit-proof verification of VAT numbers of suppliers and customers

- checking the status of all master data with regard to VAT numbers

- and thus the avoidance of back payments of input tax in the course of tax audits and special audits of input tax.

Procedure of the VAT check

- In the first step, all selected master data (suppliers or customers) are selected and placed in the „VAT audit book".

- Subsequently, the VAT numbers of the master data can be checked in the „VAT check book" using a web service. The result of the check is stored as XML in the check book (in SAP tables) and displayed as HTML.

- The „VAT check book" gives an overview of the status of the VAT number check of all suppliers and customers at any time. The 2-step procedure (first import the table into the VAT check book and then check it) simplifies the continuous updating of the master data and the associated VAT checks. In addition, an erroneous check of a large number of master data is avoided.

- In addition to the checks using the VAT check book (as described in point 3 above), you can use the F1 function Individual checks from SAP standard transactions. These checks are also logged in the VAT check book.

Prerequisites

SAP Authorizations

To use the VAT check book, the appropriate authorization must be assigned in SAP. This may

- be either the authorization for transaction /n/epo1/uid or

- or the authorization can be further restricted within this transaction.

If you have any questions about authorization, please contact your IT Support department.

Prerequisite for VAT check queries

The EPO VAT Check solution provides three different web services for VAT checking. 1, 2 or all 3 Web Services are configured and can be selected individually for each customer.

All tests function at the touch of a button.

![]()

The Web service used is displayed in parentheses. The Web service can only be selected on the selection screen and set individually for each user.

Note: With all Web Services, VAT numbers of all EU member states can be queried. The databases with the VAT numbers are maintained exclusively by the respective member countries. The Web Services thus forward the VAT queries to the respective VAT database in the responsible member country.

Requirement for Finanz Online access (Austria)

In Austria, the „FinanzOnline" web service provided by the Austrian Federal Ministry of Finance is used for the VAT audit.

Note: VAT numbers of all EU member states can be queried.

A specially created, technical Web Service User is used for queries via Web Service. This was set during configuration.

Requirement for MIAS / VIES Online access (EU)

The web service provided by the European Union can be used freely. Due to the missing authorization and the missing encryption of the data (only HTTP available) this service is much less available.

Prerequisite for BZST (Germany)

For the VAT check via the Web Service of the Federal Central Tax Office (BZSt in German), you must specify your own VAT numbers from Germany.

Prerequisite for VAT examinations with regard to Switzerland

Switzerland offers its own web service for the verification of Swiss company identification numbers. The web service must be set up technically in order to be available. If this is the case, it is automatically selected for customers and suppliers with the country CH = Switzerland. Direct selection on the selection screen is usually also possible:

- CH Swiss VAT Check.

- The web service provided by „www.uid-wse.admin.ch" can be used freely.

- As Switzerland is not a member of the EU, the EU VAT is not checked for Swiss companies, but the business identification number (comparable with the company number).

- The tax number of Swiss suppliers and customers is usually not stored in the field „Sales tax number" in the SAP master record, but in the field „Tax number 1" or „Tax number 2" for example. The EPO VAT Check takes this into account using table /EPO1/UID_FIELD, which was set during configuration.

- Special feature: For master records with the country CH and VAT numbers beginning with CH, the check is automatically carried out with the Swiss web service „www.uid-wse.admin.ch". It is therefore not necessary to select the check service in advance, since the set check service is overridden in these cases.

Requirements for brreg.no Online access (Norway)

Norway offers its own web service for the verification of Norwegian company identification numbers. The web service must be set up technically in order to be available. If this is the case, it is automatically selected for customers and suppliers with the country NO = Norway. Direct selection on the selection screen is usually also possible:

- NO VAT no. check for Norway with data.brreg.no.

- The web service provided by „data.brreg.no" can be used freely.

- As Norway is not a member of the EU, the EU VAT is not checked for Norwegian companies, but the business identification number (comparable to the company number).

- The tax number of Norwegian vendors and customers is usually not stored in the field „Sales tax number" in the SAP master record, but in the field Tax number 1 or Tax number 2 for example. The EPO VAT Check takes this into account using table /EPO1/UID_FIELD, which was set during configuration.

- Special feature: For master records with the country NO and VAT numbers beginning with NO the check is automatically performed with the Norwegian web service „brreg.no". It is therefore not necessary to select the check service in advance, since the set check service is overridden in these cases.

For the VAT check of Norwegian companies, there are no special requirements. The EPO VAT Check program is automatically using this web service for Norwegian company numbers. It is not necessary selecting the NO check service.

Overview Technology

The complete solution is developed in SAP ABAP and fits seamlessly into the standard. Therefore no installations on your workstation computer are necessary.

Basically the solution consists of 2 components:

- First, from the EPO VAT Check

- and secondly from the EPO Connector, which amongst others implements the web service of Finanz Online.

The solution is completely prepared and maintained by the company EPO Consulting GmbH.

Using the „VAT check book"

You will find all the master data to be checked in the VAT check book. The VAT check book is an ALV list (ABAP List Viewer) supplemented with useful functions for electronic processing.

Calling the VAT check book

You call the VAT check book (hereinafter briefly called „VAT PB") using transaction

- /n/epo1/uid

Note: Enter transaction /epo1/uid in your favorites in the SAP GUI (here without /n or /o in front).

Other transaction codes for checking single VAT numbers are:

- /n/epo1/uids

- /n/epo1/uids2 – An ABAP list is output here and no ALV list.

Selection of suppliers or customers and actions

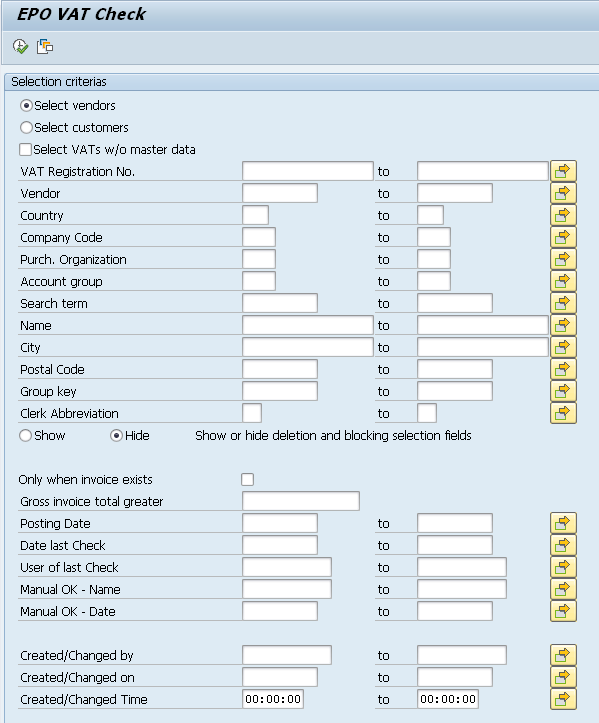

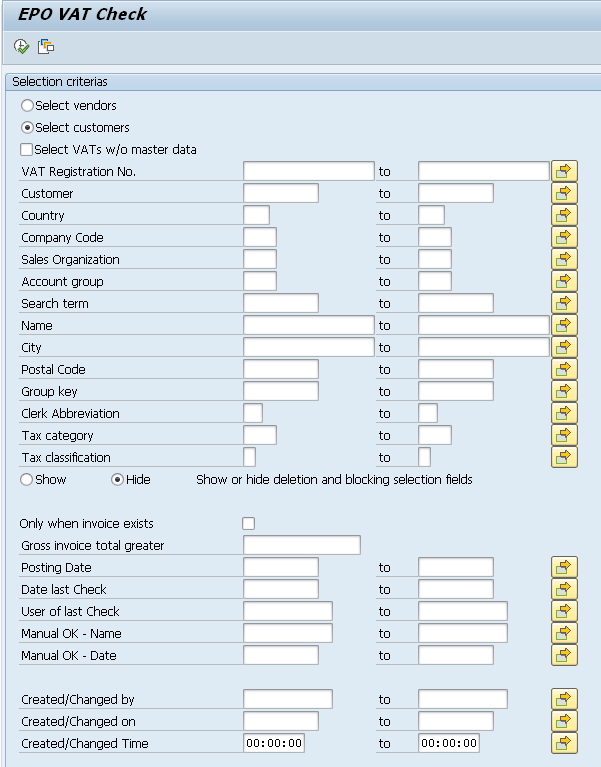

You can make extensive selections on the selection screen to restrict the display of the list.

- In the upper frame, you restrict the selection of business partners (vendors or customers).

- In the box below, select the action to be performed. You can also perform most of the actions on the list displayed in the sequence (such as the VAT check).

Screenshot selection screen „Supplier selection":

Screenshot selection screen „Customer selection":

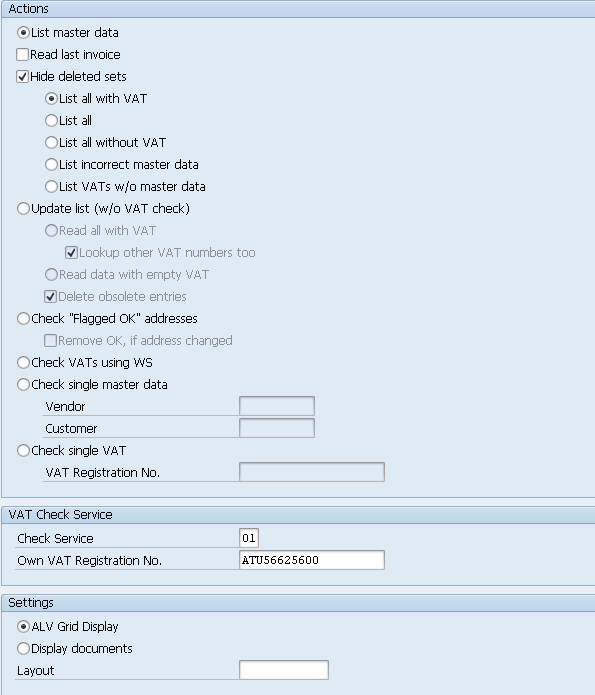

Screenshot continuation selection screen „Actions":

The selection screen provides several options (actions), which are listed below.

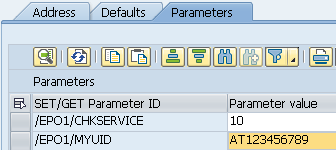

Default settings for the test service and your own VAT:

If more than 1 test service is set, the VAT Check Service can be set for each user via user parameters. By default the 1st Web Service is selected according to table /EPO1/UIDCHK_DEF or the last used check service is selected. The program remembers the last used setting.

For Norwegian VAT numbers, the Norwegian test service is selected automatically and independently of the selected test service.

The test service and the own VAT are managed via SET/GET parameters:

- SET/GET Parameter test service: /EPO1/CHKSERVICE

- SET/GET Parameter „Own VAT“: /EPO1/MYUID

The parameters can be set via the menu System - User profile - Own data.

Action: Show list of master data

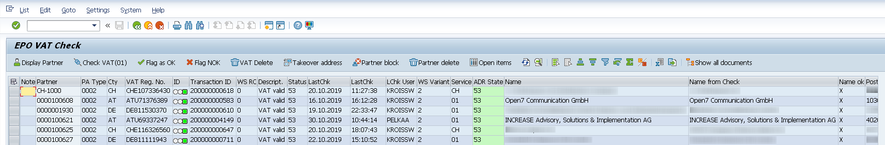

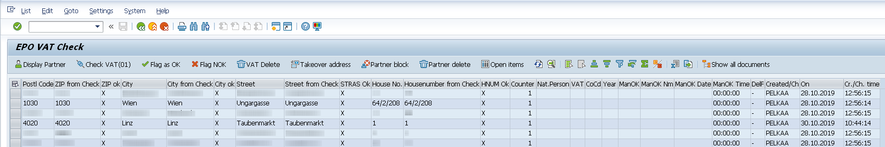

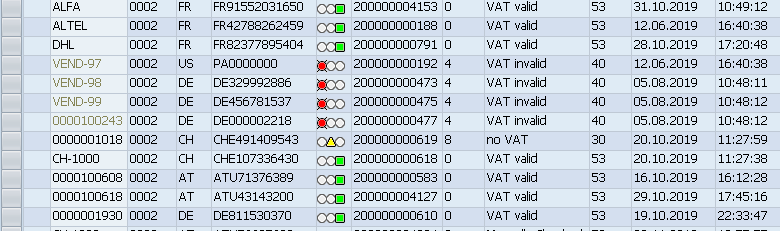

Partners already contained in the check book are displayed as follows:

Left side of the ALV list:

Right side of the ALV list:

The columns displayed have the following meanings:

| Column | Meaning | Note | |

|---|---|---|---|

| Note | Note for business partner (customer or vendor) | Notes can be easily edited by multiple selection via the menu „Edit - Note". | |

| Partner | Business partner number (customer or vendor) | ||

| Counter | Continuous counter | ||

| PA Type | Business partner Type | 0001 | Customer |

| 0002 | Vendor | ||

| 9999 | Dummy (VAT only) | ||

| (Defined in table: /EPO1/UIDCHK_PA) | |||

| VAT Reg. No. | Sales tax identification number | ||

| Status light | The traffic light symbol shows the status of the VAT check. | The last validity check of this VAT was positive.

Note: The result of the address comparison has no influence on this status. If „Manual OK" was set, this will lead anyhow to a green traffic light. | |

| No VAT available. | |||

| The last validity check of this VAT was negative.

With the web service for Norway „brreg.no", this error status is also set if bankruptcy, „under liquidation" or „under compulsory liquidation" =J in the JSON Response. This is displayed in the field Name1. | |||

| Transaction ID | Transaction number | Unique identification of a test query (EPO Connector). | |

| WS RC | Return code of the Web service used | In the case of Finanz Online, for example, the return codes have the following meaning: | |

| 0 | The VAT of the acquirer is valid | ||

| -1 | The session ID is invalid or expired. | ||

| -2 | Calling up the web service is currently not possible due to maintenance work. | ||

| -3 | A technical error has occurred. | ||

| -4 | This participant is not authorized for this function. | ||

| 1 | The VAT of the acquirer is not valid | ||

| 4 | The VAT number of the acquirer is wrong | ||

| 5 | The VAT number of the applicant is invalid. | ||

| 10 | The Member State indicated forbids such query. | ||

| 101 | VAT does not start with ATU. | ||

| 103 | The requested VAT number can only be confirmed in level 1 in FinanzOnline, since this VAT number belongs to a group of companies (value-added tax

-group). For technical reasons, no company data are displayed from the Czech Republic. For a valid level 2 query it is therefore necessary, that you call up the data of the CZ turnover tax group at http://adisreg.mfcr.cz and check whether the requested company also actually belongs to this group. Please keep the printout of this request in your documents as proof according to § 132 BAO. For each request level 2, both the confirmation procedure in level 1 in FinanzOnline and the group register in the other member state must be consulted according to the above link. If you have any questions, please contact your local tax office. | ||

| Status / Description | Processing status | 10 | unchecked |

| 30 | no VAT | ||

| 40 | VAT invalid | ||

| 53 | VAT valid | ||

| VAT Check: Date LastChk

Time LastChk LChk User |

Date, time and user of last check | ||

| Check variant | VAT Check Check variant | Only relevant for Finanz Online & bbreg.no Norway:

Finanz Online has a fixed level 2 check. In Norway, N1 = enhet (organisation) is used first and N2 = underenhet (sub-organisation) is used automatically if N1 was not successful. | |

| Check service | VAT Check Web Service | 01 | Finanz Online Web Service (Austria) |

| 02 | MIAS Web Service (EU) | ||

| CH | Swiss VAT Check | ||

| Address Check State | Status of the address check.

The address in the master record is compared with the address returned by the VAT check service. |

53 | Address OK |

| 40 | Name different | ||

| 41 | Address different | ||

| 42 | Name and address different | ||

| 54 | No Address. | ||

| 30 | Name different, Adress not transmitted | ||

| 31 | Name OK, Adress not transmitted | ||

| 32 | Adress different, Name not transmitted | ||

| 33 | Adress OK, Name not transmitted | ||

| <address fields> | Address fields from master record vs. address fields from check | Depending on the check service (Finanz Online, MIAS,...), the address of the verified partner is transmitted in addition to the VAT number. This

Address is compared with the address stored in the master record. The individual address fields (name, city, postal code, ...) are displayed next to each other. If there is a match, the corresponding OK flag is set. A match is already given if n percent of the total field length match. are right. These trimming factors are set for each comparison field in Customizing table /EPO1/UIDCHK_DEF.

104 The requested VAT number can only be confirmed in level 1 in FinanzOnline, since this VAT number belongs to a group of companies (value-added taxgroup). For technical reasons, no company data are displayed from Slovakia. For a valid level 2 query it is therefore necessary, that you access the data of the SK turnover tax group at http://www.drsr.sk and check whether the company in question actually belongs to this group. Please keep the printout of this request in your documents as proof according to § 132 BAO. For each request level 2 is to consult both the confirmation procedure at stage 1 in FinanzOnline and the group register in the other member state according to the link above. In case If you have any questions, please contact your local tax office. 105 The VAT number can be requested individually via FinanzOnline. 999 Not all required parameters were specified. 1511 The specified Member State is currently not reachable. | |

| Created/Changed by

Created/Changed on Cr./Ch. time |

User, date and time. Set when creating or changing a record. | ||

Action: Update list without check

Here you can load business partners (BP) into the check book according to the selection criteria. This initial loading of the BP is a prerequisite for the following check (see also point 1.1)

By selecting the option "Lookup other VAT numbers too", any additional VATs of the respective partner are read and also entered in the check book..

Deleting Obsolete Records

By selecting the selection parameter "Delete obsolete entries" ![]() historical records (rows) are marked for deletion.

historical records (rows) are marked for deletion.

These records can then be excluded from the display in the action „Show list of master data" (default setting).

A data record (country, partner number and VAT number) is obsolete, if the displayed VAT number is no longer entered in the master record of the partner (vendor or debitor) (e.g. because the VAT number has been changed).

You can also set deletion flags manually using the button "VAT delete" on the list. For more information, see section 2.3.

Info: Records flagged for deletion are not physically deleted.

For deleted records, the partner number is displayed in light gray:

Action: Check „Flagged OK" Addresses

When selecting the action Check „Flagged OK" addresses, only those data records are selected for which the address status has been set to „green" using the „Flag as OK" button.

This action also checks whether there has been an address change since this action (the „Flag as OK" setting),

- either in the SAP master record

- or by a new check in the web service result.

If this is the case, the address status is no longer displayed as „green", but calculated from the comparison of the two addresses.

- If the checkbox „Remove OK, if address changed" was selected on the selection screen, the flag „flagged OK" is removed in the case of address changes and saved before the ALV list is displayed.

- If the checkbox is not selected, the address changes are displayed in the ALV list, but must be edited manually.

Action: Check VATs via Web Service

You can restrict and check the BPs contained in the check book according to the selection criteria. The check service specified in 2.2.8 is used.

Attention: This action is mainly to be used for background operation, since a VAT number mass check is performed immediately here (before the results list is displayed).

Action: Individual check of business partners

Enables you to check individual BP or VAT numbers stored in the master record.

If necessary, the partner to be checked is automatically loaded into the check book beforehand.

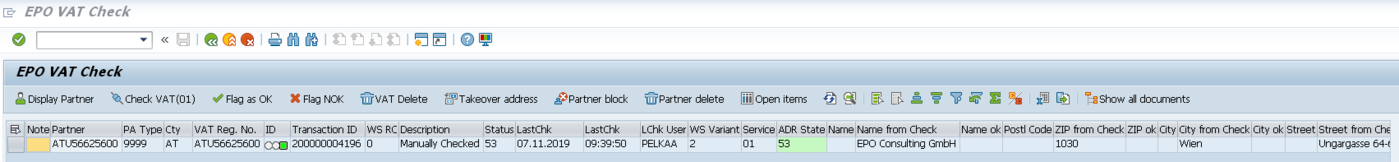

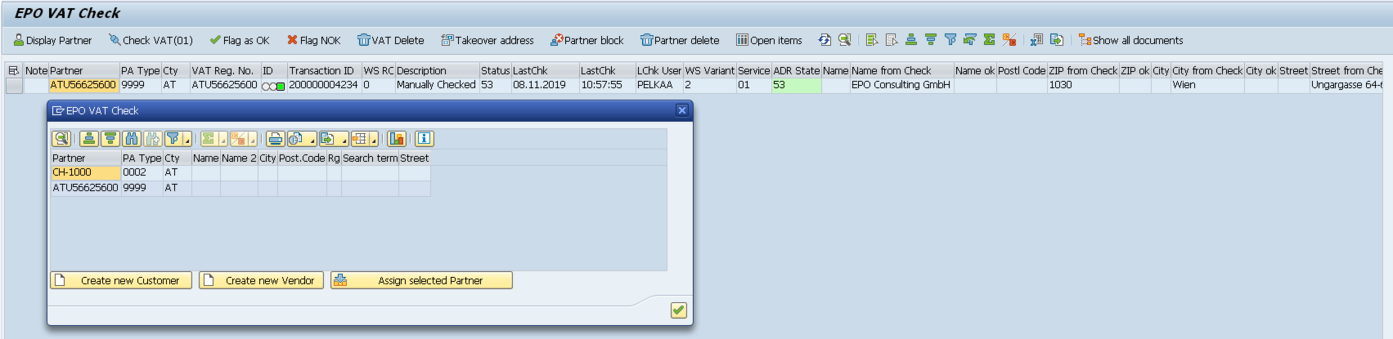

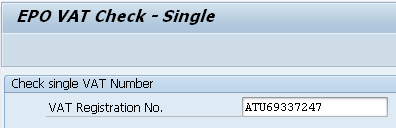

Single VAT number check

Here you can check the validity of a single VAT number. The validity of a VAT can also be checked without reference to a BP. A dummy partner is entered in the check book instead of a concrete partner. The partner number is the VAT number to be checked and the partner type „9999 dummy partner". However, if the VAT number is already used in the master record of a business partner (of the category vendor or customer selected above), the check is saved under the BP master record number.

Figure 1

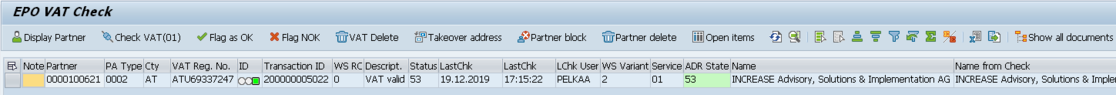

After execution, the dummy partner „ATU56625600" is entered in the check book and checked. The address transmitted by the check service is adopted.

Figure 2

Automatic partner creation

You can create a business partner directly by double-clicking on the (dummy) partner number column.

A batch input (visible) is executed with FK01 or FD01. This function can also be implemented on a customer-specific basis.

If the VAT number is already used in a master record, you can also assign this check to this master record here.

Figure 3

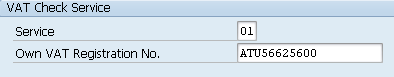

VAT Check Service

Here you can select the desired VAT verification service: Finanz Online (FOL) or MIAS or BZST or NO. Any inactive (or not configured) services are not available.

The selection of NO is not necessary, because the program automatically checks Norwegian company numbers with the web service „data.brreg.no".

Your own VAT number is sent with each check.

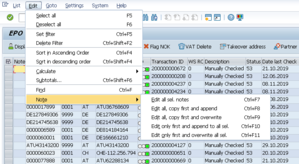

Functions on the result (ALV) List

In addition to the standard ALV functions, a number of other functions are available:

| Branches to the display transaction according to the partner type of the selected BP. Alternatively, you can store customer-specific coding here. For details, see the technical documentation. | |

| VAT check of the selected BP. Multiple selection possible.

Only, if entering notes is set in customizing to be obligatory, a popup screen will appear. | |

| Regardless of the result of the VAT check, the check status can be set to OK manually. | |

| Resetting the „Flag as OK" status | |

| Branches to the lock transaction according to the partner type of the selected BP. | |

| Display of the open items of the BP. | |

| Display of the individual check sequences and check protocols (XML response of the check service) | |

| Transfer of the address confirmed by the VAT check service to the master record. By default, this address transfer function is executed as batch input to transactions XD02 or XK02. You have the option of adapting these transfer functions to your requirements. For details, see the technical documentation. | |

| Set deletion flag. Records are flagged for deletion and can then be filtered from the results list using the selection parameter | |

|

Branches to the transaction „Set deletion flag" according to the partner type of the selected BP. | |

Editing Notes with Multiple Selection

|

The following options are available in the menu: Edit - Note:

|

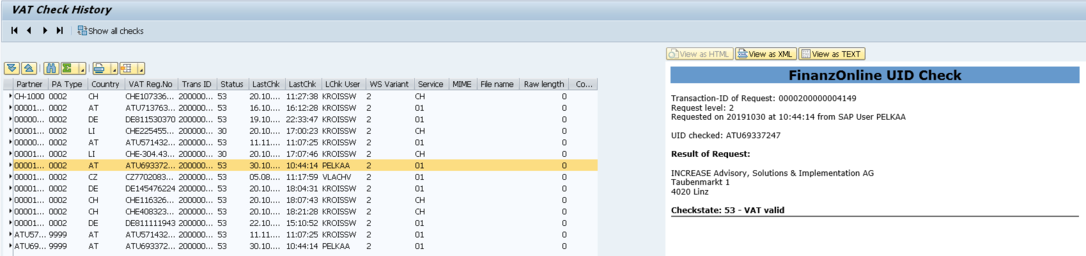

Function: Show all documents

You branch to this view via the button ![]() or you select this on the selection screen (at the bottom).

or you select this on the selection screen (at the bottom).

All check documents for each business partner, that is, XML responses for the relevant service, are displayed as HTML documents.

Use the arrow keys ![]() to conveniently scroll through all documents. Forward navigation is also possible with the function key F7.

to conveniently scroll through all documents. Forward navigation is also possible with the function key F7.

Use the Shift key ![]() or

or ![]() to select whether you want to see

to select whether you want to see

- only the most current check for each partner

- or all the checks.

According to the selected line, the respective check document is displayed in the right half of the screen, which serves as the VAT check certificate.

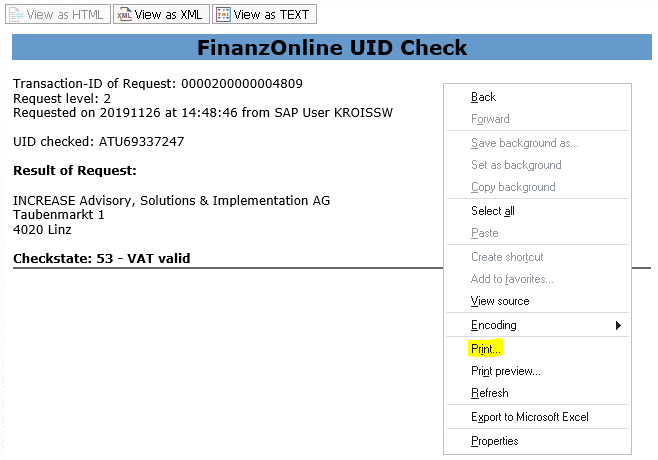

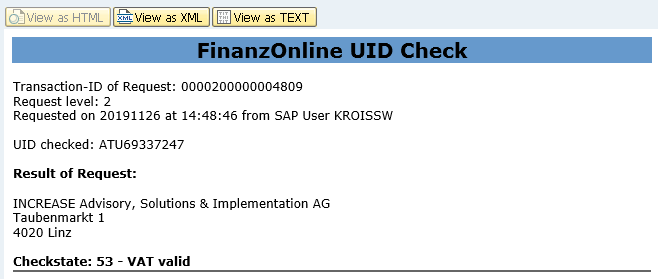

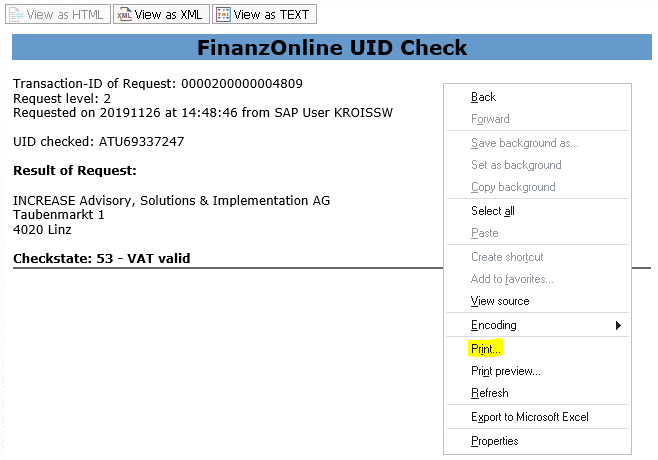

You can print the HTML document using your local printer using the context menu (right mouse button):

Display check document (HTML display)

A simple click on a test entry takes you to the detailed view of the test queries. In addition to the unformatted XML view, the requests can also be displayed in HTML format:

You can print the HTML document using your local printer using the context menu (right mouse button):

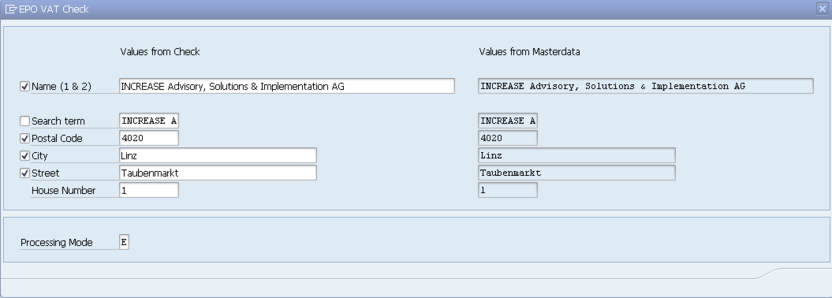

Function: Takeover address

To go to this function, choose the button ![]()

The address data of the selected test entry is displayed as follows:

By activating the corresponding checkbox, you transfer the individual address components to the master record. The values to be transferred can be overwritten beforehand. By default, addresses are transferred as batch input to transactions XD02 or XK02. You can specify the processing mode for this purpose.

F1 Context for VAT Check Status and Check

The EPO VAT Check also allows checking from the F1 context of different SAP (standard) transactions.

By setting the cursor to the field

- VAT number

- Creditor (vendor) or

- Debtor (customer)

and then F1 selection, the VAT Test Protocol popup is displayed (before F1 Help). If the VAT check popup does not appear, this is not set for your current transaction.

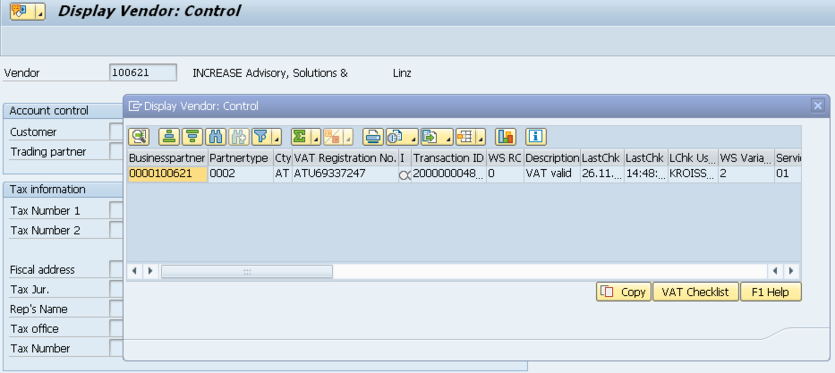

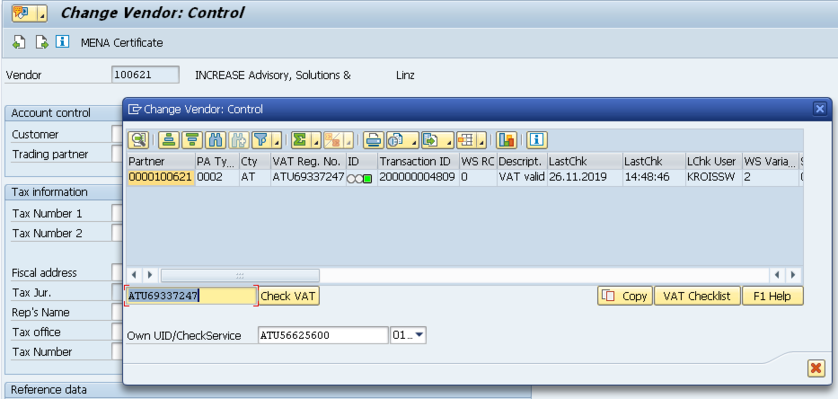

(Transaction xk03 - Menu: Goto - General Data - Control)

Ad-hoc VAT checks

If you have authorization for VAT checks and this is permitted for the current transaction, you can carry out a new VAT check directly here (bottom left button). These checks are also logged in the VAT check book.

The VAT check popup can be set for any transaction.

Figure 4: Example transaction Change Creditor (FK02)

If the cursor is positioned in the field "VAT Reg. No." and key F1 is pressed, the above picture appears. The status of the last VAT check is displayed. The VAT can be (re-)checked at this point.

Note: The F1 context is configured in the Customizing table: /EPO1/UIDCHK_F1

Individual checking of VAT numbers

VAT check with full functionality

You call the VAT check of individual VAT numbers with transaction

- /n/epo1/uids.

Note: Enter the transaction /epo1/uids in your favorites in the SAP GUI (here without /n or /o in front).

The selection screen is very simple. Once the check is complete, the ALV list is displayed with full functionality.

Figure 1: Selection screen

Figure 2: ALV list with functions

Simple VAT check

You call the simple VAT check of individual VAT numbers with transaction

- /n/epo1/uids2

This transaction is intended for use outside Financial Accounting.

Note: Enter the transaction /epo1/uids2 in your favorites in the SAP GUI (here without /n or /o in front)

The selection screen is very simple. Once the check has been completed, a print list with the check result is output. No further functions are possible.

VAT Check App

The VAT check is also available as a web application. Here single VAT checks can be made.

The test result can be converted into PDF format document.

+++ end of document +++