Inhaltsverzeichnis

- 1 This is an old version of this page. To the new page please click here

- 2 Das ist eine alte Version dieser Seite. Zur neuen Seite klicken sie hier

- 3 General

- 4 Transaction Code

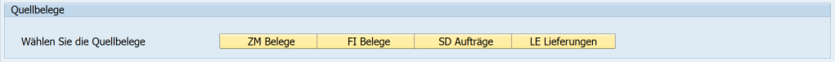

- 5 Chose the Source Documents

- 6 Selection details

- 7 The AVL-Grid

- 8 Detail analysis and ad hoc UID-Check

- 9 Authorities

- 10 Historical vs actual checkdate

- 11 Layout

This is an old version of this page. To the new page please click here

Das ist eine alte Version dieser Seite. Zur neuen Seite klicken sie hier

General

To ensure a correct periodically submitted Recapitulative Statement = Zusammenfassenden Meldung (ZM), we created this report as add-on to the existing VAT-Check. The ZM is only complete if it includes the correct VAT-numbers.

This report checks all documents that are part of the created ZM or will be part of the ZM in the future (sales, deliveries), so that only correct VAT-nummers are included.

Transaction Code

Start the report with transaction /EPO1/ZM

Beware: If you did not save the transaction as favourite, call it using /n/EPO1/ZM

Chose the Source Documents

Here you chose the document type that will be analyzed.

Depending what you have chosen, the selection details will show other selection options:

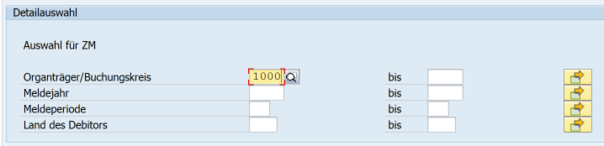

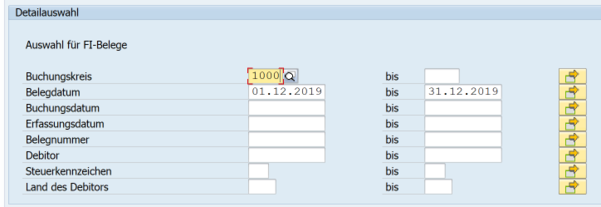

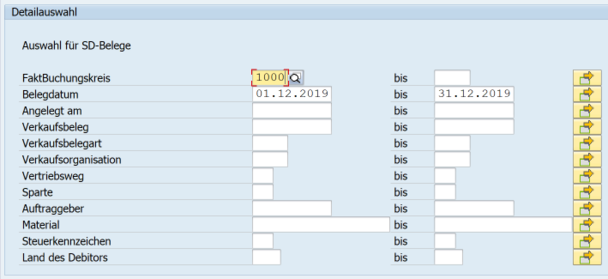

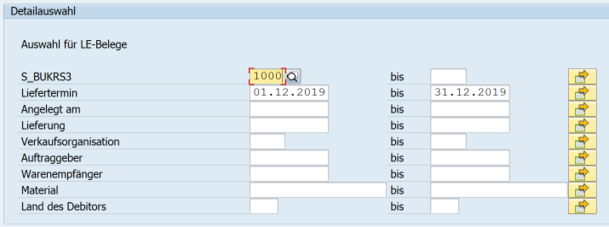

Selection details

You can narrow down your search with this selection options.

Each screen has at least the company code as most important option and one or more time dimensions. The system fills automatically the last month as proposal for the period as most of the companies create the ZM on a monthly base.

We recommend to create a favourite for your selection.

ZM

In case you use report RFASLD20 to create a csv-file for the upload to German finance authorities: Here ist the place to check it before submitting.

FI: Invoices

Especially with the option to chose the "tax code" you can reduce the analysis to deliveries into the EU.

SD: Orders

In case you want quotations / offers not in your report, you can chose relevant "Sales Document Types".

Again the "tax code" can be selcted.

LE: Deliveries

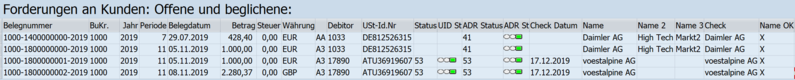

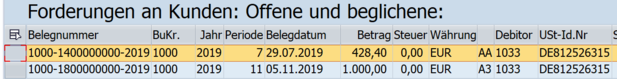

The AVL-Grid

As user of the EPO UID-Check the ALV looks familiar, especially as status and traffic light are the same. Nevertheless the report offers an optimized view only on ZM-relevant matters:

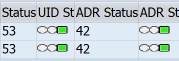

Status shows if the VAT-nummer is correct.

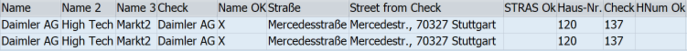

ADR Status as extended check compares the address data in your master data with data from the checkservice.

If an item of an address is OK (means ident), is shown with "X" for name, street, nr and city:

Detail analysis and ad hoc UID-Check

For details regarding document or client first highlight the line.

A click on "Beleg" jumps to the underlying document. Click on "Kunde" see the master data of the client.

Get an ad hoc VAT-Check for a highlighted line with click on "Check ID".

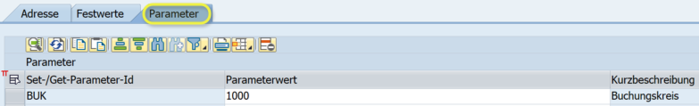

Authorities

In order to provide each user only with the information he is supposed to see, in the background there is a authority check regarding the company code.

The company code is in the report a obligatory field. To save time you can create a favourite the pre-fills these values.

Hint: Use the possibility to predefine the parameter "BUK" so that the company code is always automatically filled.

A parameter defined here saves you a lot of time afterwards as the company code is set in all transactions in the future automatically.

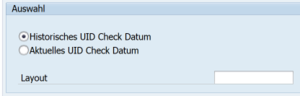

Historical vs actual checkdate

The report is created with the logic, that the VAT-checks are shown with the status at the time of your selected period. This means for example that for a chosen time period ending per 31.10.2019 no VAT-hecks after this date are taken into account.

Hence you can always prove the status of the VAT-check at a given time. This helps you to answer questions from your auditor or the finance authority.

If you chose "Actual UID check date" setzen, wird der aktuellste Check angezeigt.

Layout

You can chose already at the first screen of the transaction the layout to be shown in the ALV-grid: